A few months ago, we took a look at a complex problem: how could catastrophe insurers in California keep up with a torrent of claims in far greater number than their infrastructure could handle? The subject was particularly fraught given the inexorable link between timely resolution of a claim and customer satisfaction.

Although we were looking largely at a specific situation, that possibility of claims intake far outstripping infrastructure is on the mind of most major insurance companies today. “Flexibility” and “agility” have become the new buzzwords, because consumers have demanded it. The industry’s key customer service indicators are resolution time on a claim, response time, and effectiveness of communication- and consumers expect them regardless of the circumstances.

Unfortunately, all of those goals require an investment of human capital to do well. That capital is stretched to its limit when claims intake spikes. Even if those spikes are expected- like high-risk natural catastrophe months in the latter part of the year or high-risk car accident seasons in summer or Christmastime- companies need reliable flexible solutions. They could use a third party administrator- and many do- but ultimately that’s just transferring the flexibility problem.

So if you’re a major insurer with claims intake issues- or a third-party company tasked with solving them- what is there to do?

Limiting “Touch”

Over the past few years, insurance companies, particularly the larger ones, have been giving increased scrutiny to the concept of “touch” in their claims intake process. “Touch” simply refers to any time a human employee is required to interact with the claim, for any reason. Claims may require touch for any number of reasons: the insured may have a question, information in the claim may require review, or a decision may be required on what the resolution of the claim should be.

But what if you could automate some- or all- of that?

That’s the question 80% of insurance executives are beginning to ask themselves, according to a LexisNexis Risk survey. That just so happens to be double the interest since LexisNexis took the same survey 18 months earlier.

Claim processes break down into one of four categories, relative to their level of touch. Most companies rely heavily on “traditional” and “fast track” processes. The traditional process includes the direct involvement of an adjuster throughout the claim, and is by far the most taxing in terms of human capital. To mitigate this, many companies have implemented fast track processes, which minimize the adjuster’s involvement with programs like direct repair programs, which empower in-network body shops to write their own estimates within parameters set by the company.

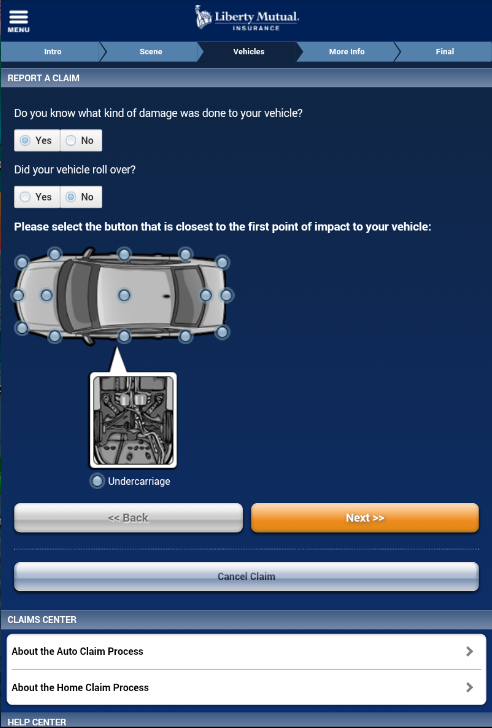

Growing in favor is “virtual claims processing.” Virtual claims processing allows the insured to upload key information, like pictures or video, over the internet. It exists as something of a halfway point between traditional and “touchless,” the fourth category, which aspires to have no human contact with the claim whatsoever. Virtual claims processing shares some processes with touchless: for instance, automatically pulling vehicle details from an attached policy, enabling first notice of loss through an online portal, and automated electronic notifications on claim developments.

Crucially, however, virtual claims processing clusters these advancements significantly towards the First Notice of Loss (FNOL) part of the claim process. Companies have been leery of incorporating more automation into the back end decision-making process, citing a lack of trust in the technology’s ability to render accurate resolutions and guard against fraud. For purposes of flexibility, though, that still leaves a hurdle. Policyholders are concerned with the speed at which a claim is resolved, not simply initiated.

Does the Consumer Actually Want Full Automation?

In an ideal world, fully-automated touchless claims would appeal equally to both consumer and the company. But while companies are enticed by the potential for claims intake flexibility and the savings offered by automation, are consumers similarly excited by a computer handling their entire claim? According to the LexisNexis Risk report, the answer is…yes.

Kind of.

The big caveat on the part of consumers is that they want to at least have access to a live human being in case something goes horribly wrong. This was particularly true for individuals who had never filed a claim before: so even the tech-savvy younger generation isn’t quite ready for a full-blown AI takeover. And companies would rather not weather accusations of a perceived lack of empathy that comes from AI-only communications. Although some appear ready to accuse their competitors!

There were a couple of other niggling annoyances, too. Customers said they didn’t want to have to answer “too many questions” and they didn’t want to have to be transferred from party to party to party. Cue everyone reading this article vigorously nodding their heads. Sounds pretty similar to something we wrote recently.

However, beyond those demands, consumers were largely in favor of a more automated claims process. Responses across age demographics indicate that consumers are becoming increasingly comfortable with self-service options throughout the claims process, particularly in checking claim status and uploading important documents. There’s slightly less enthusiasm at the thought of a fully-automated first notice of loss- particularly among older generations- but in general, more technology was viewed favorably.

These favorable opinions are only going to trend upwards. Millennials were more in favor of automation at nearly every point in the claim than their Gen X or Baby Boomer counterparts, according to the survey. It’s also worth noting that because the process itself is improving, those opinions should improve across demographic lines as consumers experience more of the benefits.

The chief benefit, of course, is time. Claims that are handled entirely via automation get to skip the queue, without waiting for an adjuster to have an opportunity to review them. Theoretically, time saved by not requiring adjuster oversight on these simpler claims would have a trickle-down effect: because thousands of low-complexity claims are disappearing from adjusters’ desks, they should be able to resolve more complex claims more quickly, as well. In this manner, every customer benefits.

Is Automation Worthwhile to the Companies?

Flexibility is a nice goal, but it’s all in service to a larger goal of managing, or even reducing, spend. If automation processes aren’t worth their weight in gold, so to speak, they won’t ever see the light of day.

It’s pretty easy to understand the argument for automation being a money-saver: less human capital and less time devoted to every claim. The Council for Affordable Quality Healthcare estimates that the US healthcare industry can save $11 billion annually by automating the business processes around claims.

The argument against is largely skepticism of the current state of our technology: can we trust artificial intelligence or rules-based protocols to effectively detect and defend against fraud losses?

In the best-case scenario, claims automation is handcuffed to an analytics service that would actually be safer against fraud. In the long-term, that’s where we’re heading. In the right-here, right-now, full AI-automation simply isn’t ready for that burden.

To date, rules-based protocols are significantly more common, largely because of the substantial time and money investments required by their AI counterparts. However, because rules-based protocols have a certain rigidity to them, their logic can be exploited if it is made known, or deduced.

This article from Shift Technology does a great job explaining these situations. As detailed in the article, companies are attempting to streamline their claims intake by identifying low-complexity claims with similar criteria that can be resolved without the use of loss adjusters. For instance, a baggage claim for under $500 or a water damage property claim for under $1500, assuming they produced no other red flags, could be paid immediately by an automated service.

What they noticed, however, was a spike in completely fraudulent claims that edged in just under the threshold. Customers figured out that they could submit multiple claims of, say, $400, and get them paid out, no questions asked.

This was even problematic for claimants with legitimate damage. Policyholders- sometimes aided by repair services that were aware of the thresholds- would exaggerate damage costs to close in on, but not cross, the automated payout threshold. Often, these behaviors would spread throughout communities, as word got out among policyholders’ family and friends. During a catastrophe, where rules-based protocols are a common tactic to dealing with a surge in claims, companies are particularly vulnerable. Without sufficient oversight over the automation process, the absence of risk provides a strong opportunity for fraud.

These concerns were shared by the respondents of the LexisNexis survey, who admitted that their biggest fears regarding automation were an increased fraud opportunity and the possibility of errors. Since most of their experience is derived from these rules-based protocols, fears of exploitation are reasonable.Until companies can build strong enough analytics departments, or AI services possess robust enough databases and precise enough behaviors, companies will still rely on a human “touch” for oversight of their automated processes.

What Will It Look Like?

The evolution of these analytic departments will take time: in order to effectively detect fraud, analytics systems need a large database to work from. It takes a lot of time and a lot of money to collect the data necessary to build a sufficient model, which means it will require a large company that is convinced of the value it can provide. Insurance executives aren’t quite there yet: only 33% of those surveyed in the LexisNexis survey admitted they were “considering” implementing fully touchless claims, and zero had them in place already. But opinions had jumped substantially in favor of touchless claims since the last survey.

The “old” ways of doing business are still profitable, so don’t expect the fully digital insurance revolution to arrive tomorrow. In the meantime, however, insurers are searching for what parts of their business are ready for a digital transformation. You can probably expect a lot more virtual loss reporting- if your insurance company doesn’t already have an app, it’s probably coming. And rules-based logic for processing claims is likely to expand, as well, as the logic that surrounds it is constantly improved.

Flexibility in claims intake is going to become expected, and inflexibility is no longer going to be forgiven. When was the last time you were told that a package was going to take longer to arrive because of increased orders? It’s jarring, no? Those same expectations are going to be had of insurance companies, who will either need flexible solutions or be able to work with third parties who can provide a flexibility solution in times of increased traffic.

This blog from Stone River lays out the exact specifications for a flexible, modern claims intake system. It leverages multiple claims reporting channels and integrates them together. It possesses a powerful assignment tool to sort claims towards their most efficient resolutions. It possesses a low-touch/touchless capability for low-complexity claims. Finally, it uses automated correspondence to keep up constant communication. (And if they’re any good at customer service, that correspondence will include the option to speak directly to a human being.)

The LexisNexis report did posit some timeline predictions. Three years until “semi-artificial” intelligence, using connection to broader sources (like Google or Amazon) to create more advanced predictive models than what we have now. In five years, they estimate full AI for certain processes, like estimates for exterior damage, incorporating multiple documents on a file, or audio transcription. In ten, they expect broad and sophisticated AI systems that can detect fraud and possibly even use behavioral analytics to sense things like a customer’s mood.

Cars that report on your driving and social media algorithms that assess risk might sound more like science fiction than insurance, but it’s the (near) future of the industry. The ways insurers are leveraging the virtual space now is just the tip of the spear.