Over the past few years, ACS’s interpreting service has experienced rapid growth. With no shortage of companies offering catch-all interpreting services, we take great pride in being the exclusive provider of interpreting services for dozens of insurance companies, TPA’s, and self-insureds, including several large non-standard writers who rely heavily on the service.

With so many other options available, though, I had to wonder- why is ACS’s service growing so well? Shouldn’t two interpreters with the same vocabulary be able to relate translated information in the same manner, regardless of where their specialization lay? Wouldn’t the interpreting remain consistent?

Spoiler alert: it does not. That may be clear to the multilingual among you, but for those of us who speak only English- those of us who really need the services these interpreters provide- it may not have been.

So I decided to ask some questions. Namely, how does having an insurance specialization make our interpreting different? Does that different also translate to better? And if it does…how much better?

I decided to ask the individuals who live this work, right in the trenches: an ACS interpreter who takes these calls daily; a transcriptionist who often transcribes the English side of calls with interpreting; and the manager who leads the foreign language team.

The Specialization Advantage

If you speak a single language, or you kind-of sort-of speak two but your college-level French is aggressively disintegrating like a cheap paper towel (i.e., me), your only day-to-day experiences with interpreting likely amount to little more than copy-pasting into Google Translate. Therefore, you might be tempted to believe interpreting on recorded statements is basically a glorified version of that role. Let’s just obliterate that notion from the get-go.

The manager put it this way: “If an interpreter interprets word for word, it’s simply going to be inaccurate. This is just something that one-language speakers imagine would be the correct thing to do- interpret word for word. This is not possible when you know two languages well and interpret well.”

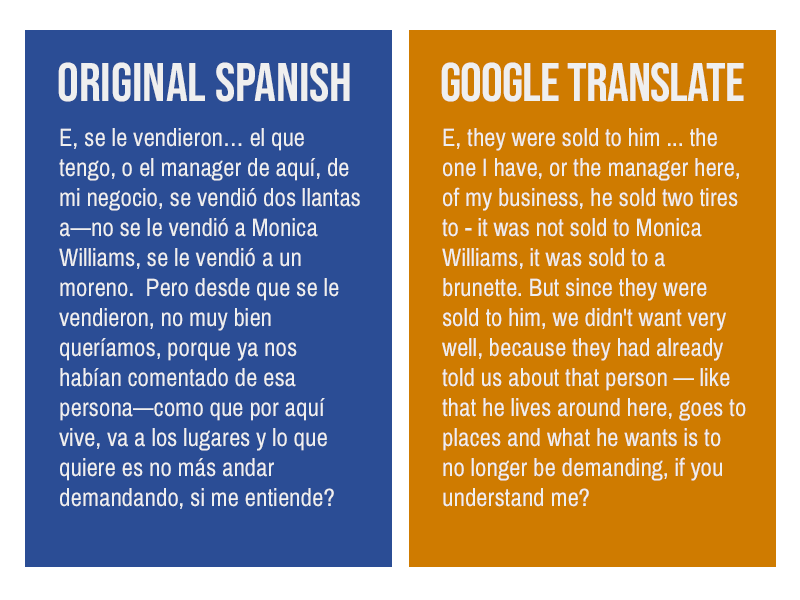

If you want a little illustration, here’s an example of an actual transcription from a call (the names have been changed). Can you make heads or tails of Google’s translation?

It’s always been part of ACS’s interpreting marketing to emphasize that we “interpret for meaning.” Simply knowing the words is not enough- the interpreting team points out that the job is considerably easier when you understand what the person is actually talking about. They hold fast to the belief that their insurance specialization matters deeply in a claims context, because it’s the very thing that allows them to interpret for meaning.

“If a non-insurance-trained (claims specific) interpreter only has to look up one word, and it’s precise, they can get away with it,” says the manager. “However, unless it’s a straightforward and simple accident detail, it’s a definite struggle because they don’t understand the concept of the insurance reasoning behind it.”

The problem with non-specialized interpreting is that when it doesn’t comprehend the intent, it must either clarify the intent, which takes precious time, or else it defaults to word-for-word translation, which is inaccurate.

Says the interpreter: “I had a call recently where the person was injured at a meat processing plant. The adjuster asked how it happened, he started explaining and I had to ask for clarification on certain machinery he was talking about, as I’ve never worked at a meat processing plant and I’m not familiar with the equipment they use. Well, she didn’t care for that and told me that she would be asking for clarification. I said, ‘Okay, we’ll do it word-for word then.’ That only lasted for about two sentences before she said, ‘I don’t understand a thing you’re talking about.’”

The Cost to You

In the previous example, I quoted one of our specialized interpreters who admitted to needing clarification- and they regularly take Workers’ Compensation calls. Imagine an interpreter who is unfamiliar with the core concepts of Workers’ Compensation in general, and think about how long the clarification process might take. Meanwhile, the clock is running- on your time, your interpreting expense, and even on your transcription fee- and potentially the far more detrimental cost of relying on misinformation and processing a fraudulent claim.

I wanted to know how much it costs to not have a specialized interpreter on the call. Our transcriptionist weighed in.

“It’s substantial,” they said. “We know when we’re doing an interpreted file from the outset, but you could tell just from looking at the total time. A statement that would take 10 minutes in English takes 30 in another language, just because of the back-and-forth. But maybe an ACS interpreter might take 20, 22, 25. You can tell the experience of the interpreter just by the amount of times the conversation bounces between the interviewee, the interpreter, and the adjuster, on the same subject.”

The manager felt it was hard to pinpoint just how much time was affected, but confirmed non-specialized interpreters take longer: “[Struggling to understand] could be a definite time-waster, for sure, when they don’t know what is happening. A well-trained non-insurance interpreter can get the work done by interrupting and asking for clarification or re-phrasing, but it takes time.”

“I’d guess 30% more time for a non-specialist,” opined the transcriptionist. “It’s really all the questions- on every front. There’s the adjuster not understanding the answers they’re getting. There’s the interpreter misunderstanding the target of the questions. Sometimes there’s long pauses with no English at all because the interpreter is having trouble explaining to the interviewee what information they’re trying to get. And sometimes an adjuster can get impatient and they try to interject in really, really unhelpful ways that just compound the whole mess.”

What’s the Problem?

Thirty percent seemed like a lot of time wasted- more than enough to cancel out the cut rates offered by other interpreting services. I wondered: where are those services getting hung up? What was it about insurance statements that could be a roadblock for non-specialized interpreters? Is it simply a lack of familiarity with insurance parlance?

The interpreter didn’t think so. “An interpreter who has become familiar with the insurance jargon and knows the exact interpretation of a certain term can relay it to the LEP (Limited English Proficient) as such, but that doesn’t mean LEP is going to be familiar with the jargon, even in their own language. Obviously, that means breaking it down for them in different words.”

That last sentence seems to be where the struggle lies. It’s a skill to discern exactly what information an adjuster is requesting, and then to request precisely that information from an interviewee in their own language, then glean precisely that information from their answer. Specialized adjusters are comfortable with this process, and adapt easily to all of the little wrinkles an individual statement throws at them. Non-specialized adjusters do not.

“Human speech itself makes the process more difficult because we do not speak as a computer would,” explains the manager. “Speakers have tendencies to speak for long periods or really get into many extras while explaining something seemingly simple as, ‘Where did you hurt your leg?’ They go in all directions and say lots of added nonsense.”

The ability to parse through that “nonsense”, or even the confidence to redirect a meandering interviewee are essential skills in a claim interpreter’s toolkit. The cost of not having those tools can be dire.

The manager added that as the conversation moves quickly, unfamiliar words or phrases, like a localized name for a body part, can get lost in the shuffle, and aren’t always returned to and clarified. Particularly on statements that follow a string of events- like a car accident- one missed detail can spell doom for understanding the larger picture.

“The interpreter may hear lots of ‘Left, right, then this happened,’” says the manager. “In these scenarios, if they lose focus for a short moment, there goes the story. Focus, and fast and accurate note-taking are a must.”

“On one call, the back-and-forth went for over six minutes on a single thing,” remembers the transcriptionist. “It was something really simple. The adjuster was trying to establish where the interviewee’s car had been prior to the accident. They were trying to figure out if the interviewee had recently changed lanes, and the timing for that. But they weren’t able to say it that way, and the interpreter kept coming back with the same answer, reiterating that the interviewee was behind the other car before impact, and then going on into the impact point. The interpreter wasn’t getting that the answer that they were ‘behind’ the other car was too vague for the adjuster, and the adjuster kept getting frustrated at receiving the same answer and couldn’t articulate what they were asking for. They ended up having to circle way, way back to clarify the answer, and it really annoyed everyone on the call.”

It wasn’t one of my initial pursuits when I began the interviews, but adjuster frustrations boiling over seemed to be a common refrain among the testimonies.

“Some adjusters are under the impression that the conversation will be robotic and seems they expect a black and white, clear cut response,” said the interpreter. “We all know that is not how conversations typically work, especially if you have no knowledge of certain environments.”

Can an adjuster actually make a call with a non-insurance trained interpreter worse?

“Oh, absolutely,” thinks the transcriptionist. “It’s a skill. You can tell when an adjuster isn’t comfortable with the interpreting process, isn’t confident about taking the lead. I’ve noticed a good interpreter will gently nudge in a direction of where they think the adjuster intends to go, or clarify their intent before asking anything to the interviewee, to save time and ensure accuracy. But the ones that don’t- the interpreter ends up feeling frustrated that the adjusters can’t seem to articulate what they want and the adjuster ends up frustrated in the opaqueness of the answers. I’ve even seen them openly suggest that the interviewee is being deceitful or evasive for stuff I thought was pretty clearly just a misunderstanding. Sometimes it’s even confirmed as such, later in the call.”

Time, Money, Headache

It seems overly simple to conclude that interpreters who have insurance-specific training are better at interpreting insurance statements. Then again, it’s kind of overly simple, and somewhat naive, to go with an untrained interpreter because they bore the lowest per-hour price tag.

Like anything in business, this bears evaluating within the confines of your own company. Do your statements suffer when your adjusters are on a call with an interpreter? Does your adjuster’s performance, or their attitude, regress? Are your adjusters- the end user- being consulted in the process of selecting an interpreting service, or are you sending a message that the lowest cost-per-minute is all that counts?

Would that cost consideration change if you were to experience a 10% decrease on all the time spent on interpreter calls? Twenty percent? Thirty?

ACS’s commitment is to accuracy over expediency; whether that also translates into a savings to your company is something you have to evaluate, but we believe that the expense of training interpreters in proper interpreting protocol and insurance concepts provides an extraordinary value to our customers.

When I asked our manager why she felt companies keep choosing ACS, she had a simple answer.

“Save time, money, headache.”